Services Provided

1040X forms for 2013, 2014; federal and California tax return for 2015; my wife's ITIN application

Experience and Good Comments

I had been filling tax return for 5 years as a non-resident alien student. I became resident alien in the middle of 2015. So I felt it was complicated for that year and I needed a professional to help.

In our first appointment, Ms. Chou asked some basic facts about me. At the beginning, I was not sure if she knew how to fill tax for non-resident aliens. Within a few minutes, she not only convinced me that she is familiar with the matter, but also quickly identified that I failed to claim child credit for the previous years. She offer to amend the tax returns for 2013 and 2014 as well as filling the 2015 tax return for me. The 2015 tax return included both California state return and federal one. Also, since I became resident alien, I am eligible to file joint tax return with my wife. So Ms. Chou also needed to apply ITIN for me wife. At the end of the appointment, she gave me a list of documents she needed.

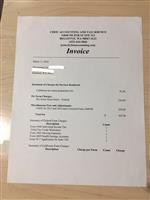

A few days after I gave her assistants the documents, she prepared a package containing the tax forms for 2013, 2014, and 2015. I was so surprised by the amount of tax IRS owed me: $5835 for 2015, $1988 for 2014 and $1975 for 2013. After signing the documents, I gave them back to Ms. Chou's office, and she sent them to IRS on my behalf.

As the ITIN application and the tax forms were handled by different IRS offices, and in my case tax forms were reviewed before ITIN application, IRS corrected my 2015 tax forms and only refunded me $5262.53. After I contacted Ms. Chou, she disputed with IRS for me on this issue and finally convinced IRS to pay the remaining $607.79 including interest due to the delay.

In the end, my wife got her ITIN and IRS refunded all tax as requested in the forms Ms. Chou prepared.

Not-So-Good Comments

The scanner in Chou's office didn't seem very good. Because IRS initially rejected my wife ITIN application because her passport copy was not clear enough. So I had to scan it again on my own and had Ms. Chou send it to IRS again